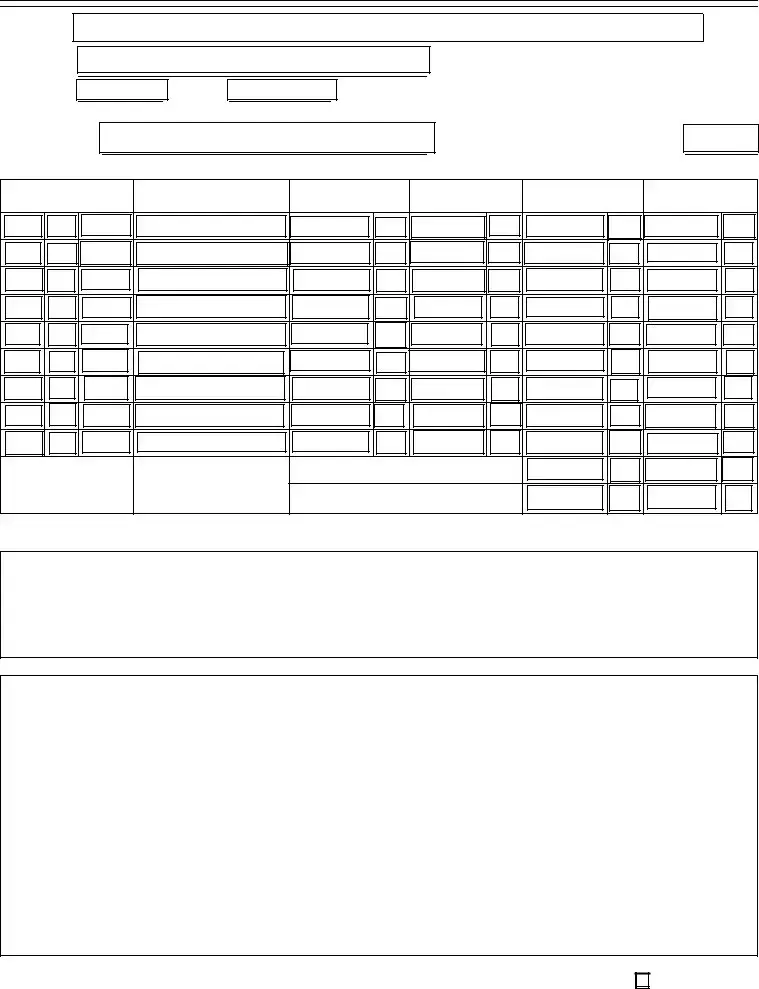

Item 2 minus Item 3

Enter in Column “A” the taxable Wages subject to contributions as listed on the Original Return.

Enter in Column “B” the correct amount of Taxable Wages subject to contributions. Enter difference between Columns “A” and “B” in the appropriate Column “C” and “D”.

Enter in Column “A” the Contributions listed on the Original Return. Enter in Column “B” the amount of Contributions due on corrected wages by multiplying Item 4B by the Contribution rate in Item 1. If Column “B” is larger than Column “A”, it represents Additional Contributions Due, and the difference should be entered in Column “C” (INCREASE). IF Column “B” is less than Column “A”, it represents an Overstatement of Contributions and the difference should be entered in Column “D”

(DECREASE). If a DECREASE, a refund may be issued, if applicable.

Enter in Column “C” the interest due on the additional contributions due. Multiply item 5C by the appropriate interest rate. One percent interest is charged for each month, or part thereof, that this return is filed late. Example: If the quarter being filed is the first quarter, the due date is April 30. Beginning May 1st , calculate 1% interest due. On June 1, 2% interest; on July 1, 3% interest; etc. If it is a second quarter return, interest begins to accrue August 1st; for a 3rd quarter return, November 1st; and for a 4th quarter return, February 1st .

Enter in Column “C” any penalty on the additional contributions due. A penalty of ten percent (10%) or fifty dollars ($50), whichever is greater, is assessed if the balance of contributions due is not paid within thirty days of the due date. Penalty dates: 1st quarter —June 1st; 2nd quarter—September 1st; 3rd quarter—December 1st; and 4th quarter—March 1st. Note: penalty may not be due if it was already assessed on the original return. Please call the Employer Tax Accounting Unit (860)263-6470 for any necessary clarification.

Enter the total Amount due (the Sum of Items “5C”, “6C” and “7C”). Pay online at: www.ct.gov/doltax

Explain the reason for Correction fully. If additional space is required, attach a letter furnishing all facts and refer to the letter in this space.

This correction return must be signed by a responsible and duly authorized person and mailed to the address listed above. Any payment due, however, must be made online at www.ct.gov/doltax.