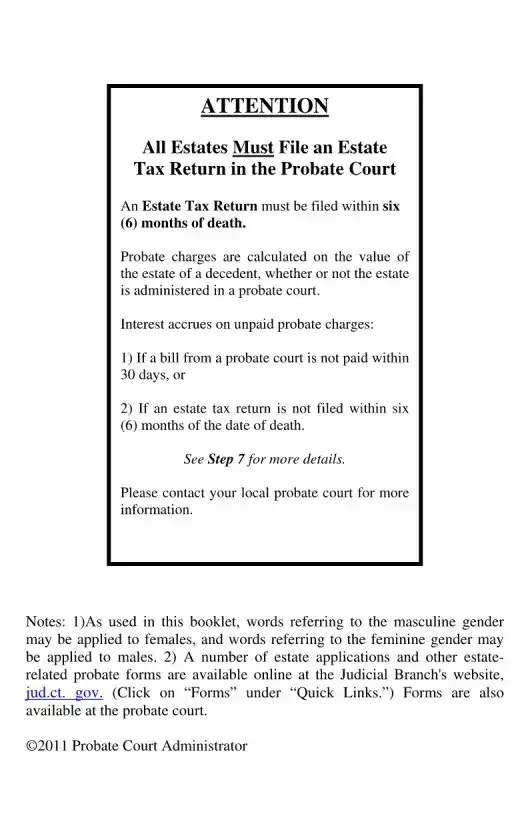

In Connecticut, the probate process is a crucial step in managing the affairs of a loved one who has passed away. The Connecticut Probate form plays a significant role in this process, serving as a guide for those tasked with settling a decedent's estate. When a person dies, their estate must be administered according to their wishes if a will exists, or according to state laws if they died without one. This means that the probate court will oversee the distribution of the decedent’s assets, ensuring that any outstanding debts, funeral expenses, and taxes are settled before beneficiaries receive their shares. Within six months of the death, an Estate Tax Return must be filed, and probate charges are based on the estate's value, regardless of whether it is formally administered in court. The responsibilities of the fiduciary, whether an executor named in a will or an administrator appointed by the court, include managing the estate's assets, maintaining fairness among beneficiaries, and filing necessary documents with the probate court. Additionally, there are provisions for simplified procedures for small estates, making the process less daunting for families dealing with limited assets. Understanding these aspects of the Connecticut Probate form can help ease the transition during a challenging time, ensuring that the decedent's wishes are honored and their estate is managed responsibly.